10 Credit Card Tips for Students

As summer ends and students prepare to return to university, signing up for a credit card may seem like the simplest solution to make ends meet. However the repercussions of accumulating debt and being stuck with extremely high interest rates that you are unable to repay would be devastating.

Here are 10 credit card tips students should follow to ensure that this would not happen.

- Use your credit cards responsibly

Smart credit card usage is the best way to build up your credit history. Use your credit card to make purchases such as groceries and petrol, but be sure to pay your bills on time. Remember, even one or two late payments will affect your credit score.

- Start with a retail card for a specific store

Just like a major credit card, a retail card will help you build your credit score. They are easier to qualify for, but usually have lower spending limits and higher fees if payments are missed.

- Open a secured card

A secured card requires a cash deposit equal to the credit card limit. This is used as collateral. The deposit can be a few hundred, or a couple of thousand dollars, depending on the user’s ability to pay.

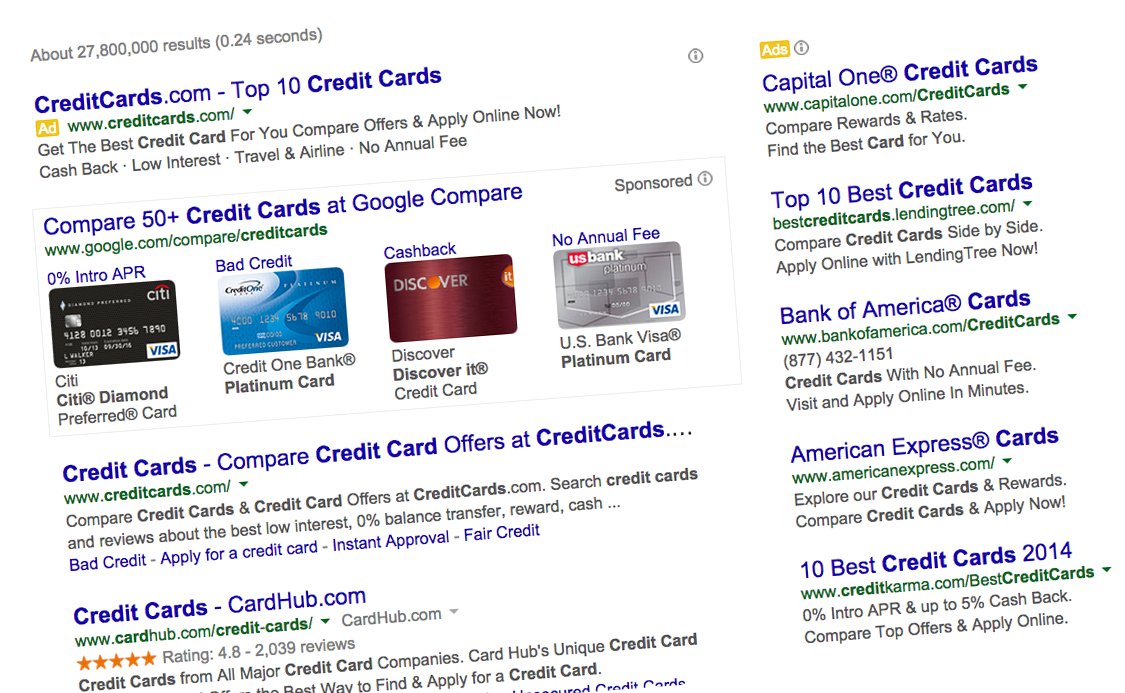

- Look for cards that charge low fees

Sit down and review the options available before you apply for a credit card. For example, I had a look on a couple of the usual comparison sites and the cards on CB Online were surprisingly good. Cards with excessive transfer fees, late fees and annual percentage interest rates of more than 15% should be avoided. The better your credit score, the better the rate you will receive.

- Talk to your bank

If you already have a savings account, ask your bank if you can get a bundle deal for a credit card.

- Ask your parent to make you an authorized user of their card

Laws restrict credit card marketing on campus; yet, students still receive numerous offers. Students can easily be tempted to sign up for cards to cover personal expenses. Ask your parents to add you on their credit cards so you can easily turn down these offers.

- Apply for a debit card

If you have concerns about your money management skills, a debit card is better than a credit card. You will still need to keep track of your spending, but will be unable to spend more than the available balance.

- Don’t be fooled by “offers”

Credit card companies like to target students with offers and incentives that appeal to the young. Despite what the ads imply, most cards come with minimal rewards and high interest rates. Your credit score will also go down every time you apply for a line of credit.

- Read the fine print carefully

Most people do not read the fine print but it is something you should always do. Know the specific terms of the agreement you are entering into, as well as, any fees, interest rates or benefits the card gives you.

- Apply for one credit card only

Do not accept multiple credit card offers as a large amount of credit equals a large amount of debt. Some cards come with a temporary rate that expires after a while which is then replaced by a permanent rate that is much higher.

Ensure you consistently make payments on time and pay more than the minimum balance as this will cost you less in the long run: Do not max out your credit card as this will also impact your credit score negatively.

Category: Featured